santa clara county property tax rate

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. GASB 44 Economic Condition Reporting 10-year data Property TaxValuation related Changes in Net Position Changes in Fund Balances of Governmental Funds General Governmental Tax Revenues by Source Taxable Assessed Value of Property Property Tax Rate.

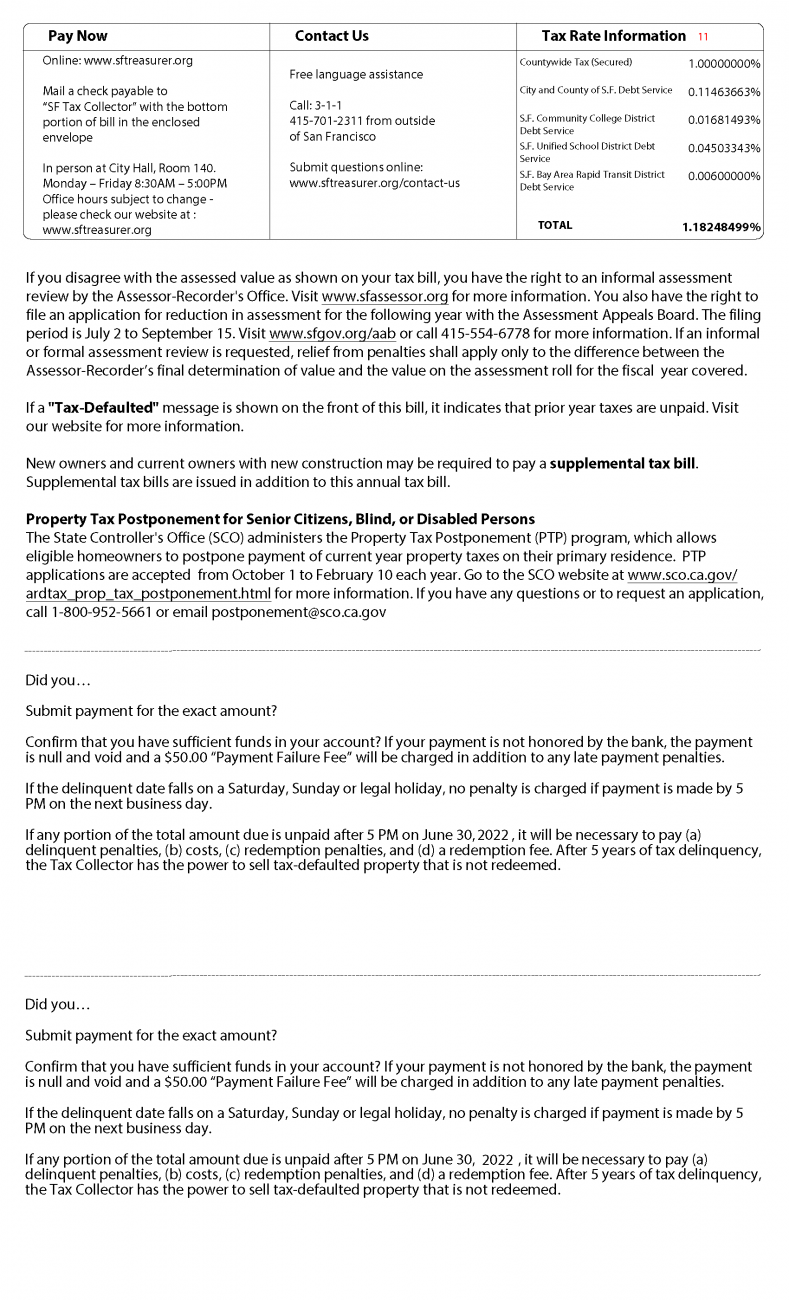

Secured Property Taxes Treasurer Tax Collector

Santa Clara County comprises San Jose and Silicon Valley making it one of the wealthiest counties in America.

. Property Tax Rate Book Property Tax Rate Book. See Property Records Deeds Owner Info Much More. The County of Santa Clara Department of Tax and Collections has partnered with an external lockbox service to process property tax payments.

Learn why Santa Clara County was ranked a top 40 Healthiest Community by US. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Learn more about SCC DTAC Property Tax Payment App. We offer drop-in or appointment service for visitors to the office. Santa clara countys due date for property taxes is what it is.

Property Taxes--Secured and Unsecured The County cities schools and other local taxing agencies derive a portion of their revenue from property taxes. The median property tax on a 70100000 house is 469670 in Santa Clara County. Below are the different addresses on your stubcoupon that your bill payments are sent to.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. With almost 2 million people living within its boundaries its a popular place to stake a claim but like any other place to acquire real property youll want to have an in-depth understanding of the Santa Clara County property taxes. Because of these high home values annual property tax bills for homeowners in Santa Clara County are quite high despite rates actually being near the state.

The median home value in Santa Clara County is among the highest in the nation at 913000. Get Record Information For Any Address About Any County Property. Property taxes are levied on land improvements and business personal property.

The median property tax on a 70100000 house is 518740 in California. Learn all about Santa Clara County real estate tax. Gross receipts and compensating tax rate schedule effective january 1 2022 through june 30 2022 a a b b b.

The average effective property tax rate in San Bernardino County is 081. COUNTY OF SANTA CLARA PROPERTY TAXES. FY2020-21 PDF 150 MB.

News and World Report. The median property tax on a 70100000 house is 736050 in the United States. The fiscal year for santa clara county taxes starts july 1st.

Tax rates can be complicated even without a lack of transparency so it is easier to look at the tax rate as a percentage of property value. However most business can be conducted by phone email or via web services. Pay your 2nd installment by April 11th to avoid penalties and fees eCheck payment is free.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value. On June 21 2021 full in-person customer service resumes in the Assessors Office. The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations.

All the taxes listed in separate lines on the bill are distributed directly to the agencies levying the charge except for the one percent tax which is shared by many local tax agencies. Property taxes are levied on land improvements and personal property under legal authority from California Codes. Lien date for all taxable property.

Compilation of Tax Rates and Information. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Your annual property tax bill separately lists all the tax rates including the one percent tax voter approved debts and special assessments. Home Page Browse Video Tutorial Developers. In Santa Clara Countys case the tax rate equates to 0.

Enter Property Parcel Number APN. County of Santa Clara. Property Taxes - CAFR Statistical Section.

Search Any Address 2. Pay secured property taxes online prior to midnight pacific time on December 10 and April 10 to avoid penalties. This leaves an unpaid balance of 2000.

FY2019-20 PDF 198 MB. Skip to Main Content Search Search. Santa Clara County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. Santa Clara County Assessors Public Portal. Santa Clara County Property Tax.

Ad Find Santa Clara County Property Tax Info For Any Address. Tax Rate Book Archive.

Santa Clara County Property Tax Tax Assessor And Collector

Property Tax By County Property Tax Calculator Rethority

Understanding California S Property Taxes

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Understanding California S Property Taxes

Understanding California S Property Taxes

Prop 19 Changes In Property Tax Rules California General Election Ballot Measures Voter Guide November 3 2020 Voter S Edge California Voter Guide

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Property Tax Tax Assessor And Collector

The Santa Clara County Coalition Behavioral Health Services County Of Santa Clara

Property Tax By County Property Tax Calculator Rethority

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Couple That Sold Their Home To Mark Zuckerberg For 14 Million Gets A Property Tax Surprise East Bay Times