2022 annual gift tax exclusion amount

In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

If gifts are made through a trust the trust.

. For 2022 the current amounts for each taxpayer are. The federal government imposes a tax on gifts. In 2018 2019 2020 and 2021 the annual exclusion is 15000.

ANNUAL GIFT TAX EXCLUSION. The annual exclusion applies to gifts to each donee. Increase of Annual Gift Tax and Estate Tax Exclusions in 2022.

If you give more than 15000 in. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017.

13 rows For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. 5 annual pre-tax return. For any amount over that you must file IRS form 709.

The maximum credit allowed for adoptions for tax year. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. For gifts given in 2022 you can gift up to 16000 without having to file any tax paperwork.

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax.

13 rows Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of. Itll also limit the donor to. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or.

The annual exclusion amount will increase for the first time in four years moving from 15000 per person per year to 16000 per recipient for 2022. The publication of this revenue. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual.

In 2022 this threshold is 16000. Gift Tax Annual Exclusion. However as the law does not concern itself with trifles Congress has permitted donors to give a small amount to each.

In 2022 the gift tax annual exclusion increased to 16000 per recipient. Gifts to beneficiaries are eligible for the annual exclusion. Estate and Gift Tax Exemption.

The gift tax annual exclusion allows taxpayers to make certain gifts without using their lifetime exemption amount. Gift tax rules for 2022 onwards. The current 2022 gift tax exclusion amount of 32000 per married couple per recipient 16000 per individual per recipient 10 years of gifting.

How Is the Gift Tax Calculated. This is the amount you can.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What You Need To Know About Stock Gift Tax

Irs Announces Higher Estate And Gift Tax Limits For 2020

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

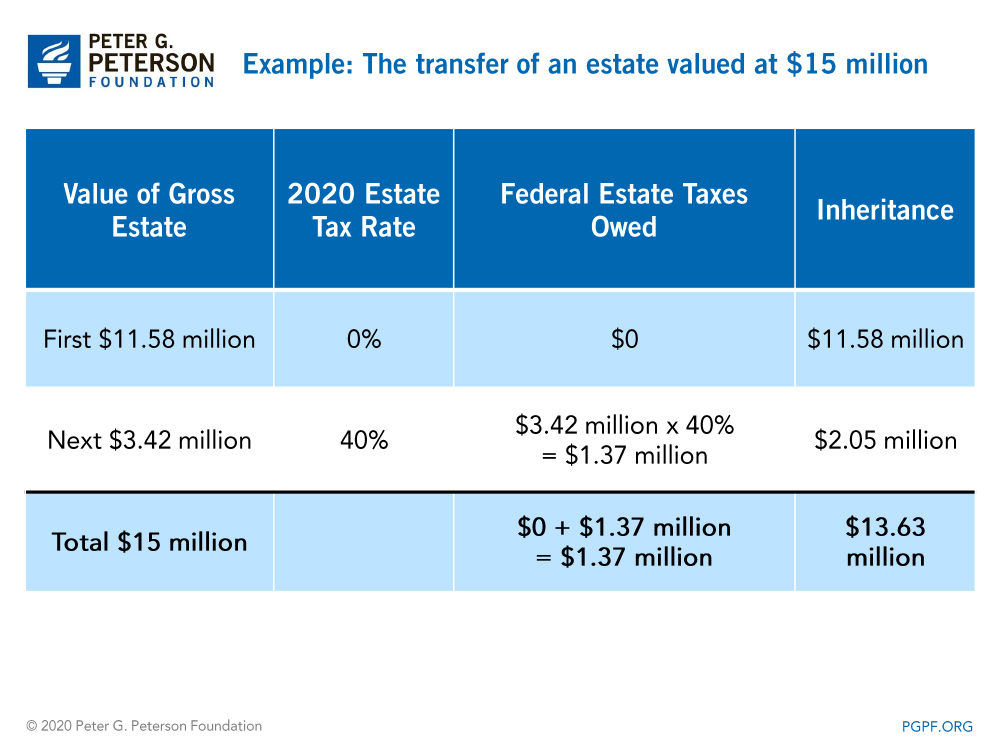

What Are Estate And Gift Taxes And How Do They Work

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Who Pays Taxes On A Gift Gift Tax Exemption The American College Of Trust And Estate Counsel

How Does The Gift Tax Work Personal Finance Club

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

What Are Estate And Gift Taxes And How Do They Work

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)